Instant bank payments

Instant bank payments for merchants - fast, secure, and compliant

Our instant bank payments let your customers pay directly from their bank accounts - no cards, no waiting, no hidden fees. Enable instant payments to receive funds immediately with real-time Open Banking technology.

What are instant bank payments?

Instant bank payments are real-time digital payment methods. Customers transfer money directly from their bank account to the merchant’s account. Meanwhile, instant payments are processed and confirmed within seconds, 24/7, including weekends and holidays. They’re powered by modern Open Banking and instant payment systems such as SEPA Instant.

We combine instant bank payments with Open Banking

Our feature is designed to help businesses receive payments faster, more securely, and with greater customer accessibility. Open Banking connects thousands of financial institutions across Europe to meet the growing need for faster payments. It maintains secure transactions, creating one of the world's largest financial ecosystems.

Key benefits of Genome’s solution

Instant payouts

Genome allows for instant settlement and confirmation of payments received via SEPA Instant Transfers. Receive funds from customers within seconds instead of waiting for days.

Access to more clients

With us, you get access to the European Open Banking system with 2,000+ bank integrations. Allow customers across Europe to pay you through one Open Banking connection.

Lower fees

Our instant bank transfers have lower processing fees than card networks. Businesses save on every transaction or payment with reduced fees and no chargebacks.

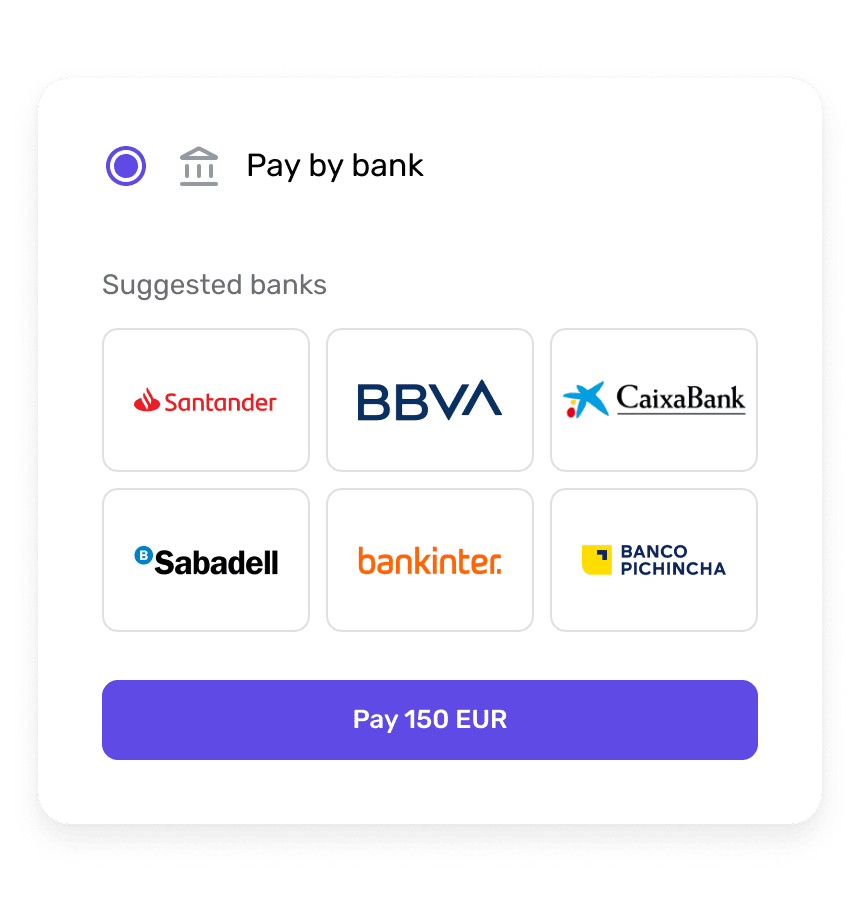

Less issues at checkout

The feature we offer allows for frictionless checkout with hosted payment pages and reduced user drop-off. Customers can use the Pay-by-Bank services with no need to enter many additional details.

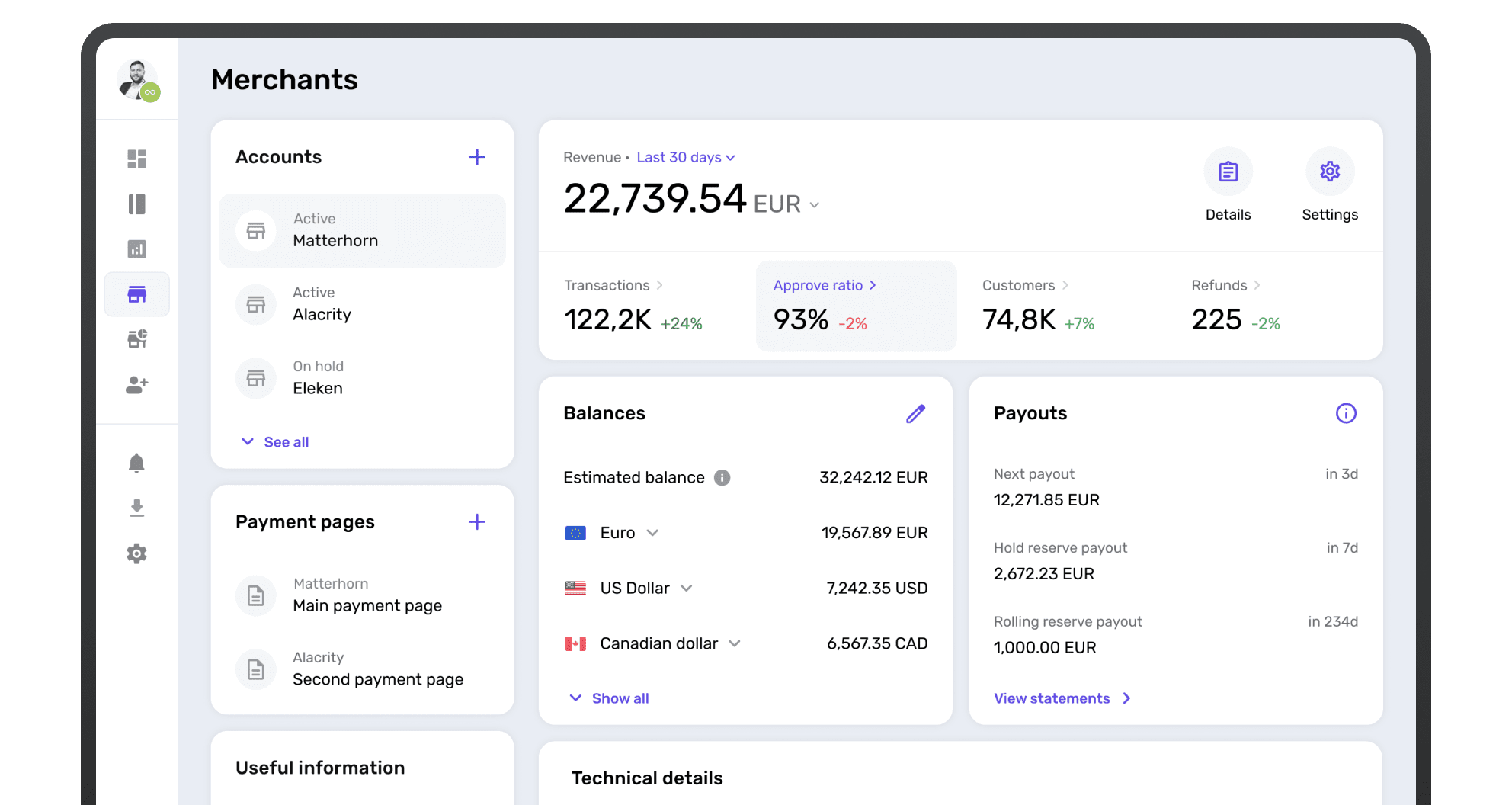

Multi-currency support

We offer a multi-currency account for all your operations: settle funds into one of your business accounts and then exchange funds between your accounts seamlessly, in 12 currencies.

Security of payments

With us, you automatically get enhanced security and compliance. Every transaction customers make proceeds with an advanced encryption and risk monitoring system.

Instant bank payments

Who can use instant bank payments?

Genome’s instant payment solutions are designed for any business that relies on the payment process and could benefit from faster transactions or needs to verify customer payments faster.

E-commerce industry

E-commerce businesses access instant payments, enjoying a seamless payment experience. It ensures that a customer's order made via Pay-by-Bank can be fulfilled promptly, and money can be sent easily.

Digital service providers

Digital service providers benefit from immediate settlement and enhanced cash flow management. They gain faster access to funds, which reduces the risk of chargebacks or failed transactions from users.

Travel industry

Travel businesses can utilize instant payments to provide immediate booking confirmations, ensuring that a hotel room or flight is secured for customers without requiring payment to settle.

iGaming companies

The iGaming sector heavily relies on money transactions and customers' trust. Instant payments for quick and secure deposits and withdrawals in real time could be game-changing for businesses.

Fintech providers

Industries such as Fintech also take advantage of compliant, encrypted payment systems, capable of handling large transaction volumes of fast bank transfers with complete security for their users.

Other industries

We are an all-in-one platform to manage accounts, bank transfers, and payments. With real-time processing and full visibility over your money movement and customers’ payments, you can scale your operations confidently.

How do instant bank payments work?

Instant bank payments utilize Open Banking technology, enabling customers to connect directly with their banks and transfer money from a bank account in real-time. Transactions are processed via the Pay-by-Bank feature, which enables customers to send money, pay for a product, or make any other legal payment through their bank accounts.

When a customer initiates the “Pay-by-Bank” service, the bank verifies and processes it instantly, depositing the funds into the merchant’s account within seconds. That’s because the payment form is fully prefilled with the amount and recipient details, so the user only needs to log in and choose the account to pay from. These payment details cannot be changed.

Are instant bank payments safe?

Yes. Genome’s instant payment system utilizes multi-layer encryption, strong customer authentication, and advanced fraud detection tools to ensure transaction security. Our services are regulated under EU law, ensuring compliance and creating peace of mind for both merchants and consumers.

What’s the difference between SEPA Instant and Open Banking payments?

SEPA Instant is an instant payment system that moves funds directly between participating banks within the SEPA zone. Open Banking is used to initiate a SEPA Instant transaction. Through the Open Banking API, we connect to the financial institution and send a request with all the payment details (amount, recipient, description, transaction type, etc.), asking it to initiate the transaction. Once the bank approves it, the payment is automatically created, and the user confirms it.

Genome implemented both technologies, offering merchants the flexibility to accept instant transfers across Europe via SEPA Instant and Credit Transfers while maintaining full compliance and security of the payment process. And, of course, to transfer money for business purposes via the SEPA system. Both single transfers and batch transfers are available.