Merchant services

How Open Banking payments work for merchants

Enable your business to receive instant bank payments from clients across Europe, powered by safe and transparent Open Banking tools. Explore new revenue streams, improve operational efficiency.

What is Open Banking?

Open Banking is a regulated way for people and businesses to securely share their bank account data and broader financial data. It is also used to initiate payment services through standardized APIs with the help of licensed financial institutions. Instead of screen-scraping, regulated third parties (other financial service providers, fintechs, PSPs) use bank APIs only with the customer’s explicit, permissioned consent.

Compliance and security of Open Banking

Open Banking is enabled in the EU by PSD2, which mandates API access and licenses compliant providers. Security and control are central: Strong Customer Authentication (SCA), encryption, and auditable consent flows protect your data and authorize payments safely. Inside Genome, we use compliance-first monitoring that keeps both financial data and payment services protected end-to-end.

How to accept Open Banking payments

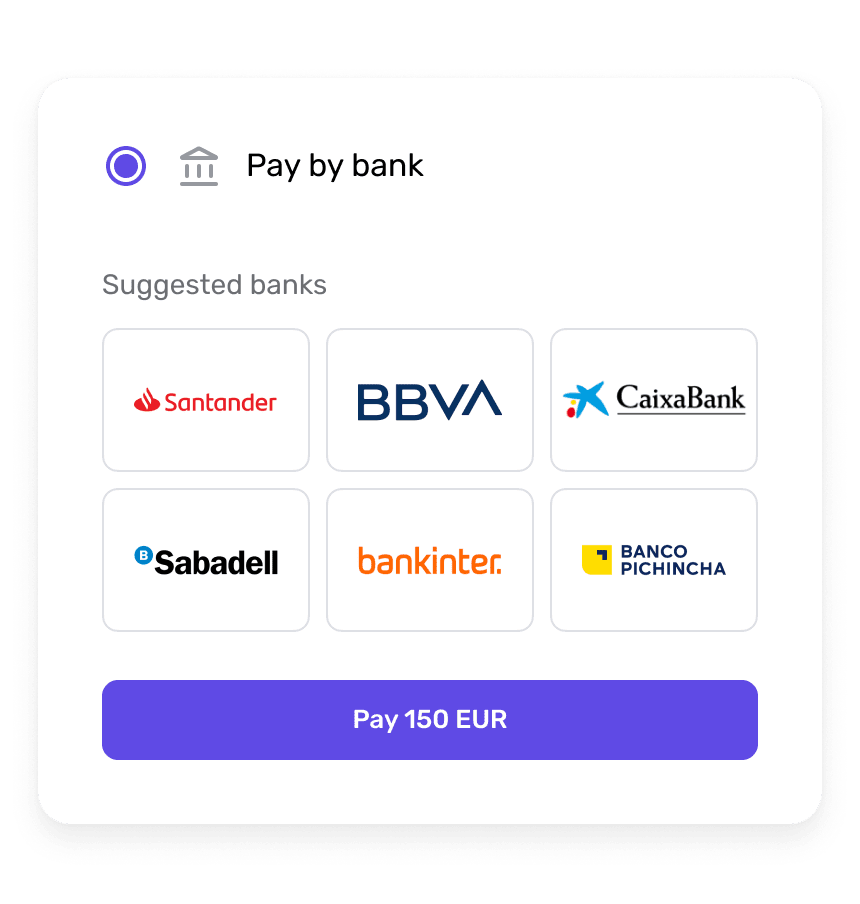

Customers pay businesses directly from their bank accounts, using the Pay-by-Bank option instead of debit/cards, while keeping financial data protected. Consumers approve the Pay-by-Bank transaction, businesses (merchants) receive it, and banks hold the accounts and move the funds. Regulated financial service providers enable these Open Banking services across the broader financial services industry. Here's how the process happens:

-

A customer picks the Pay-by-Bank option and confirms the payment in their bank app when making purchases.

-

The money is sent to the merchant via SEPA Instant Transfer (arrives in seconds) or SEPA Credit Transfer (usually same-day/next-day payment).

-

The merchant accepts bank transfers using Genome's instant bank payments feature.

Benefits of Open Banking

Along with instant bank payments, we offer hosted pages, instant notifications, and reconciliation tools used across multiple financial sectors.

Merchant services

Using Pay-by-Bank, customers pay merchants straight from their bank account. No cards or intermediary banking services required. Merchants get clearer visibility on each pay-in, lower fees, and no chargebacks compared to other payment methods. Accept payments from clients across Europe with ease with our elevated financial services.

Hosted payment page

Open Banking quickens the payment process for fintech companies and clients. And so does Genome’s hosted payment page, perfect in combination with instant bank payments. Our page guides clients through this flow, redirecting them to a secure external link to complete the purchase. It reduces friction and simplifies the process.

SEPA Instant/Credit transfers

Genome enables real-time payments for merchants thanks to SEPA. SEPA Instant Transfers can deliver funds in seconds. Meanwhile, SEPA Credit Transfers are cleared within a day. Businesses benefit from faster settlements and a smoother cash-flow cycle, while your financial data stays protected.

Batch transfers

Merchants need to pay out salaries, partners, or issue refunds at scale. Instant bank transfers allow businesses to receive payments from clients efficiently. This way, merchants can plan their financial operations accordingly, including mass transfers, using real-time financial data.

Dedicated IBAN account

Merchants settle the funds received via Open Banking-powered payments directly to a dedicated business EUR IBAN account. It is an account that companies receive automatically after starting a wallet inside the Genome financial ecosystem. Merchants can add more IBANs if necessary and benefit from other financial services we offer.

Multi-currency accounts

After accepting funds into a business account, merchants can transfer funds between multi-currency accounts. They get 12 different currencies for better corporate management: EUR, USD, GBP, PLN, CHF, JPY, CAD, CZK, HUF, SEK, AUD, and DKK. They can add up to 5 accounts per currency.

Genome is an EU-licensed EMI, compliant with:

Instant bank payments within Genome

With us, merchants can access Open Banking-powered instant bank payments from clients all over Europe. We offer merchant services to accept direct transfers, hosted payment pages, multi-currency accounts with dedicated IBANs, SEPA, and SEPA Instant rails. Businesses can unlock batch transfers for mass payouts, currency exchange, real-time notifications, and compliance-first security and monitoring.

Start accepting instant payments across Europe

Contact Genome for more information regarding Open Banking-powered payments and other merchant services.

Contact usIs Open Banking mandatory for banks?

Yes. In the EU/EEA, PSD2 requires banks to offer secure API access to licensed providers. These rules cover payment initiation and account information, including instant bank payments (via Open Banking). They apply to regulated financial institutions and support standardized interfaces for Open Banking payments across the EU.

Who regulates Open Banking in Europe?

Open Banking in Europe is framed by PSD2 and related regulatory technical standards at the EU level. National competent authorities supervise banks and licensed third-party providers offering Open Banking payments and data services. The European Banking Authority issues guidelines to promote consistent supervision and protect customer and consumer financial data. These frameworks also affect real-time payments and instant bank transfers enabled through Open Banking interfaces.

How can businesses integrate Open Banking APIs?

Most businesses connect through a licensed PISP/AISP. With Genome, merchant accounts can accept Open Banking–powered payments via instant bank payments from clients. Our feature is working across multiple banks and suiting medium and small businesses that need a fast, compliant setup.

What’s the difference between Open Banking and traditional banking?

Traditional banking keeps data and payments inside a single bank’s systems. Open Banking uses standardized, regulated APIs to share data and initiate account-to-account payments with consent. It gives users more control, enabling tailored financial products, and supporting new business models.