Merchant services

Open multiple merchant accounts online in Genome

When you open an account for merchant services, there are lots of details to consider. The right merchant account services will help your business to accept payments with ease. Learn how to get a merchant account for your needs.

Merchant services

What is a merchant account?

A merchant account is a type of business bank account that lets businesses accept credit/debit card payments, bank transfers, and more. You can start accepting payments by partnering with a merchant account provider, merchant services provider, or Genome. How do merchant accounts work? Payment processors are used to swiftly process payments from clients who use a debit/credit card or other e-payment method. The money you receive is efficiently and safely transferred to your business checking account. As the world increasingly turns to online transactions, the need to accept virtual payments and debit card transactions continues to grow rapidly.

Merchant services Genome offers

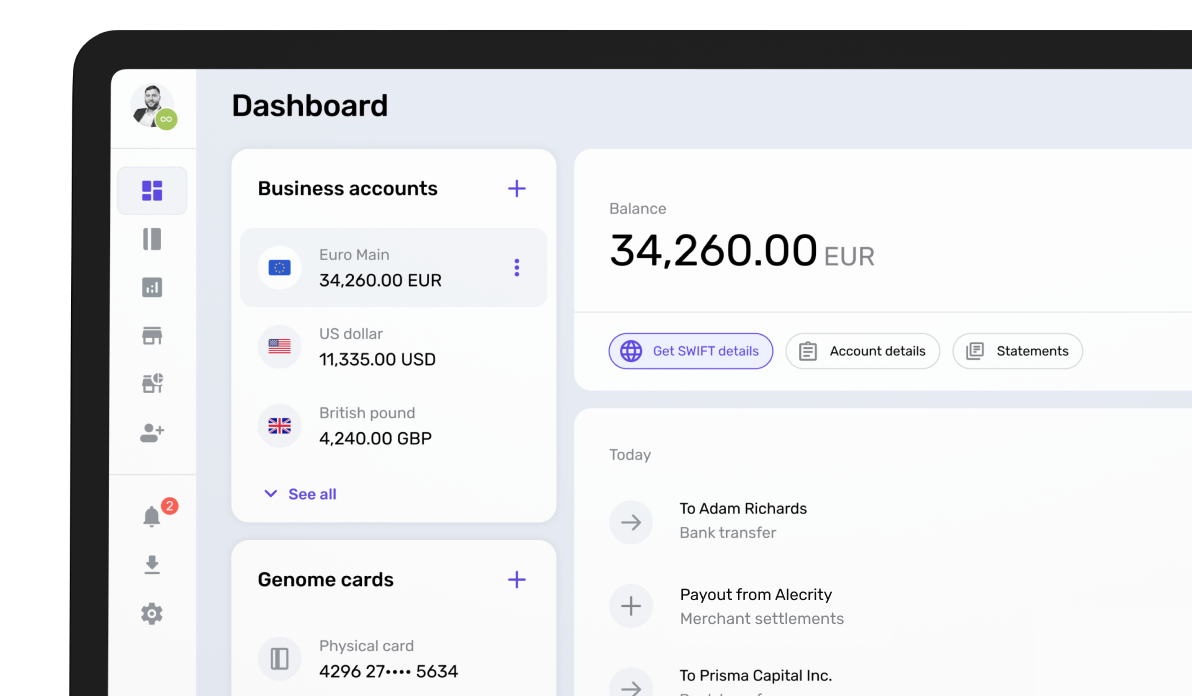

Genome lets your business accept payments securely, access transfers across Europe, and benefit from advanced anti-fraud tools. Businesses also enjoy the benefits of SEPA Instant Transfers and international money transfers, including SWIFT payments. 24/7 access to your account through Genome’s online platform and app gives full control at any time.

Online payment processing

Let customers with bank accounts all over Europe pay you quickly and securely with SEPA Instant/Credit bank transfers. And stay tuned - credit and debit card processing is launching soon!

Recurring and subscription billing

Genome is perfect for e-commerce, iGaming, SaaS companies, and digital services providers. Automate regular payments smoothly while ensuring secure transactions. Use advanced reports to track them.

Multi-currency accounts

Accept payments and get them settled into your business bank account. Exchange currencies between your multi-currency accounts in EUR, USD, GBP, PLN, CHF, JPY, CAD, CZK, HUF, SEK, AUD, and DKK.

Security and compliance

Genome ensures that your data and payments are protected at all times - we maintain full compliance as an EU-regulated EMI. Genome is PCI DSS, PSD2, DORA, and GDPR compliant, has ISO 27001/27701 certifications.

Merchant services

How to open a Genome merchant account

Step 1

Step 2

Step 3

Merchant services

Do business your way with our merchant payment services

Financial institutions impose many rules and demands upon companies when it comes to merchant account opening. You might see strict merchant account requirements that make it awkward to get started, particularly for what banks consider high-risk merchant accounts. Or you might be put off by a high monthly fee or a one-off setup fee. In some cases, opening a merchant account requires you to put in a lot of time and effort. We provide online merchant account options that are simple to access, so you can start to accept electronic payments after completing the process to open your account. It gives you related services like payment processing and SEPA Instant/Credit bank transfers.

Why choose Genome for merchant services?

As an Electronic Money Institution, we combine the best practices of traditional banks with advanced financial services the fintech industry offers. It makes financial services and merchant account opening accessible, convenient, and swift. Genome is safe to use, as the financial operations are protected from fraud. Here's why companies choose us for a business wallet, merchant account, payment processing, and more:

Licensed EU EMI

Genome is a fully compliant EU Electronic Money Institution, licensed and supervised by the Bank of Lithuania. The security of your funds and data is our top priority!

Transparent pricing and competitive fees

Enjoy clear, upfront pricing with no hidden charges for separate business categories. Genome offers competitive fees to help businesses manage costs efficiently.

Integrated financial ecosystem

Easy access to features via the app or the website dashboard. Inside Genome, we combine your business account and merchant account for seamless financial operations with all the essential services.

Dedicated support team

Every merchant in Genome gets a dedicated account manager. They provide professional assistance and specialist technical knowledge to answer any questions regarding integration, setup, etc.

Merchant services

Discover more Genome services

Instant payouts

Receive clients' payments and instantly settle them into your business account to use for your operational needs!

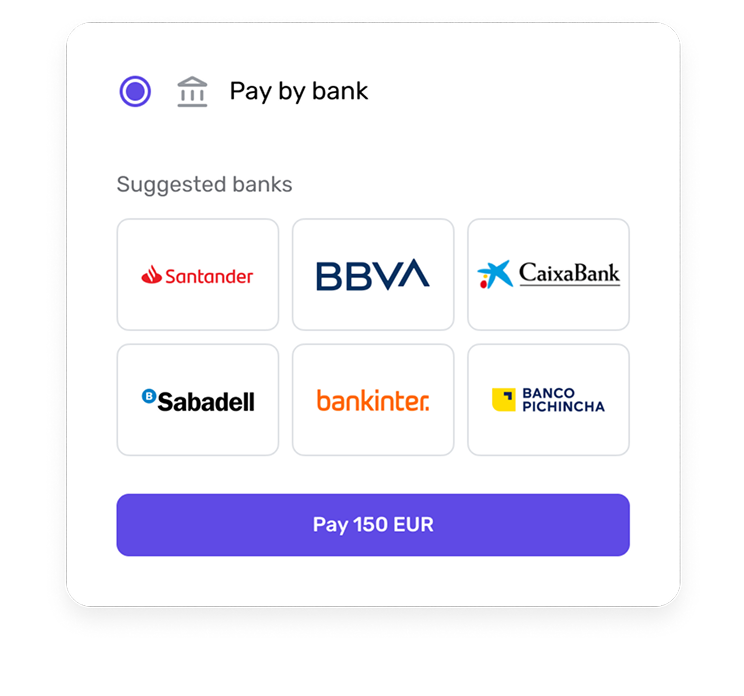

Accept payments via Open Banking

Customers can pay merchants directly and within seconds thanks to SEPA Instant Transfers.

Hosted payment pages

Hassle-free hosted solution for your website - allow clients to pay through a redirect link quickly and securely.

Merchant analytics

Use advanced merchant analytics tools to oversee and optimize your merchant account performance through one platform.

Merchant services

Want to know details? Contact us

Genome merchant

Do you have any questions regarding Genome?

Find answers here or contact us using the application form

How to get a merchant account?

You can start a merchant account if you have a company and need to accept credit cards, bank transfers, and other electronic payments. A bank or a payment service provider might have different requirements for companies to apply for a merchant account online. With Genome, the process is simple, safe, and swift.

How to apply for a merchant account online?

You will only need access to your phone, Genome's website, and identification documents for you and the company. The onboarding process is carried out online. First, you are required to open a business checking account. When that is done, apply for a merchant account online: provide information about your company, as well as scanned documents that confirm the ownership. Depending on how many merchant accounts you need, you can start additional merchant accounts on our platform. Feel free to contact our customer support if necessary.

What is a merchant account fee?

Choosing the right merchant account provider, with reasonable processing fees and an efficient process, is one of the keys to growing your business online. Business owners need to pay fees for merchant account services, for instance, a monthly minimum fee, a transaction fee, etc. Genome's fees for some services differ for low-risk and high-risk accounts. For more information on merchant account fees, visit Genome's pricing page.

What is the best merchant account for small businesses?

Small businesses usually need to distinguish themselves from their competitors by excelling in their products and service quality. Genome can help with the latter. Start a merchant account for your online business and get frictionless, swift payment services on your website. Your transactions will be protected with our anti-fraud tools. You can also open as many merchant accounts as you might require. Read how to create a merchant account on our page.